EU General Court confirms landmark Google Android decision with strong signal for tougher antitrust enforcement in digital ecosystems

On 14 September 2022, the General Court of the European Union in Luxembourg upheld the landmark Google Android decision of the European Commission (“EC”) of 18 July 2018 (the “Decision”) in all relevant parts. The comprehensive judgment (Case T-604/18) (the “Judgment”) confirms the EC’s finding that Google LLC and its parent company Alphabet Inc. (“Google”) abused their market dominance on several markets over a span of more than seven years.

In essence, the case concerns several agreements that breached EU antitrust rules, in particular rules on tying and exclusivity. Google completed such agreements with device manufacturers and mobile network operators, as part of the licensing of Android, its operating system (“OS”) for smart mobile devices. According to the findings of the EC, these practices pursued the overall objective of protecting and strengthening Google’s dominant position for general search services and the related search advertising revenues. The condemned conduct hindered the emergence of competitive threats to Google during the crucial shift of Internet consumption from desktop computers to mobile devices – which had, at that time, represented a window of opportunity for rival search services. As a result, businesses and consumers are deprived of the opportunity of using a broader scope of alternative Internet services today, culminating into less choice, innovation, and higher prices.

The EC’s historic Decision ordered Google to cease its anti-competitive practices. In particular, the Decision required Google to break its tight grip on the entire Android-based mobile ecosystem by means of interlocking agreements with different players therein (notably, mobile network operators and device manufacturers). The EC had also imposed a fine of EUR 4.34 billion, the highest fine ever imposed on a single undertaking for a breach of competition law. The previous record had also involved Google – EUR 2.42 billion in the EC’s Google Search (Shopping) decision of 2017, which has already been confirmed by the General Court.

Today’s Judgment marks the second victory for the EC under Competition Commissioner Margrethe Vestager before the General Court against Google. Conversely, considering the far-reaching consequences for Google’s business model, the Judgment constitutes the most significant legal defeat in the company’s history.

What is the Google Android case about?

On 18 July 2018, after five years of investigation and following five formal complaints from competitors and industry associations, the EC adopted a comprehensive prohibition and fining Decision against Google (Case AT.40099). The Decision was based on Article 102 of the Treaty on the Functioning of the European Union (TFEU), which prohibits the abuse of a dominant market position.

The Decision found that since 2011, Google had abused its dominant position in the worldwide markets for Android app stores and the national markets for general search services by means of four separate but closely interrelated anti-competitive practices, which constituted a single and continuous infringement of Article 102 TFEU.

When said practices were rolled out, the Google Search service had already enjoyed a super-dominant position on nearly all European markets. As the Commissioner put it in 2018, “Google has used Android as a vehicle to cement the dominance of its search engine”. As rightfully concluded by her, Google “denied rivals the chance to innovate and compete on the merits”.

The EC found that Google imposed a set of anti-competitive restrictions on manufacturers of mobile devices along with operators of mobile telecom networks. The restrictions relate to the licensing of the Android smart mobile OS, a service for which Google’s market share exceeds 95%. Such restrictions were contained in three types of interwoven agreements with the acronyms MADA, AFA, and RSA. They formed part of a “carrot-and-stick strategy” to protect and strengthen Google’s position in general search:

- MADAs (Mobile Application Distribution Agreements) ensured that a suite of proprietary mobile applications (apps) developed by Google – the so-called Google Mobile Services – are preinstalled on all Android devices. Among the mandatory preinstalled apps were those that constitute the main search entry points on any device – that is, search apps and web browsers. To this end, Google made the licensing of its must-have Google Play app store conditional on the device manufacturer or mobile network operator also preinstalling, among others, the Google Search app and the Google Chrome browser (for which Google Search in turn is the pre-set default search service). The agreements also contained an additional element of premium placement for Google’s services, which had to be more visible than any rival services that might be preinstalled alongside them. Because of user’s status quo or default biases – of which Google had been well aware – such restrictions created a distribution advantage to the benefit of Google Search and Google Chrome that rivals could simply not offset by resorting to other distribution channels. Indeed, according to the EC’s unequivocal findings, users rarely change the defaults on their smart mobile devices. Both the EC and the General Court rejected the idea that the MADAs were necessary to protect the “free nature” of the Android ecosystem and the unrealistic assumption that competition is “just one download away”.

- RSAs (Revenue Share Agreements) complemented the MADAs. They are deals between Google and hardware manufacturers or mobile carriers to share revenues generated with Google’s search advertising on specific devices or a portfolio of devices. In effect, RSAs effectively amounted to anti-competitive exclusivity payments, as mobile carriers and hardware manufacturers had to agree to not include any competing search service in addition to Google Search on any of their phones in return for receiving their revenue share. The anti-competitive object of such agreements is apparent, and Google could not bring forward any plausible explanation as to why RSAs were necessary or justified. In particular, given that the MADAs already ensured that Google Search was preinstalled, the sole objective of the RSAs could only have been to fully exclude rivals from the Android platform. Google’s sole defense was that the market coverage of such agreements was too little to effectively foreclose competition. This argument disregards the fact that any niche could have been the nucleus a rival needed to attain a critical mass of users to be able to enter the market or improve its services. In addition, Google already occupied all other relevant entry points for search services through similar agreements (for example, with Apple and with independent browser developers such as Opera and Mozilla).

- AFAs (Anti-Fragmentation Agreements) had the goal of reducing the risk of a so-called “fragmentation” of the Android platform (according to Google). Because parts of Android are “open-source” software - or at least marketed as such - software developers could theoretically have created alternative versions of it (so-called “forks”). The AFAs forbade any such “forking” of Android and thereby hindered the development of differentiated and innovative software platforms along with new devices (such as, for example, the Amazon Fire Phone). Therefore, under the guise of – purported – fragmentation risks, Google hindered the emergence of rival (open-source) Android-based mobile ecosystems that could have been a credible competitive threat to its own, walled-off ecosystem and served as a means of distribution for rival search services. Together with other restrictions (such as proprietary software layers like Google Play Services, without which the core of the Android OS is of little use), the AFAs turned Android into the most closed open-source project ever. It was open-source in name only.

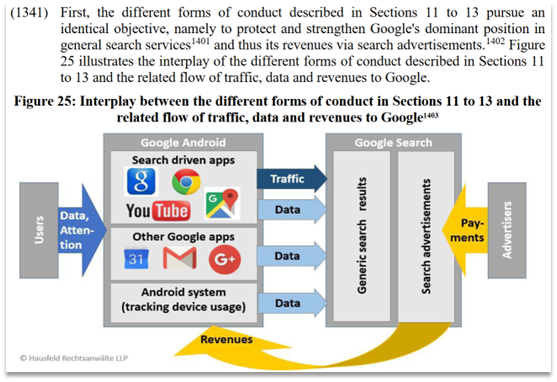

With such interlocking restrictions, Google attempted to shield its general search service Google Search from competition and to sustain its search advertising monopoly. Google had already locked nearly all distribution channels outside of Android, and through the development and marketing of its own, tightly closed-off mobile ecosystem, attempted to take total control of the developing mobile search market. By occupying all entry points for search services, Google built “moats” – that is, unsurmountable barriers – around its core revenue and data generating services and funnelled users and user data into its services, giving it extraordinary, lasting market power and a massive visibility and data advantage. Adopting a submission by Hausfeld, the EC illustrated the interplay of the different forms of anti-competitive conduct with the following overview in its Decision:

What did the General Court decide?

Today, the General Court of the European Union – which is the Court of First Instance in the two-tier EU judicial system – dismissed Google’s appeal against the EC’s Decision in all relevant aspects. The Judgment follows an oral hearing in September 2021, which involved over 40 lawyers on Google’s side alone and which lasted five days – the longest hearing since the landmark Microsoft v Commission (Windows Media Player/server interoperability) antitrust case in 2006.

The Court annulled the Decision only with regard to the portfolio-based RSAs, which Google had ceased using in 2014 in any case, reducing the fine by less than 5% from € 4.34 to € 4.125 billion. This was unsurprising in light of the scepticism shown by the Chamber during the oral hearing regarding the EC’s economic analysis of RSAs.

General Court upholds all major findings of the Decision

The Court confirms all findings of the Decision relating to the anti-competitive effects of MADAs and AFAs. Those findings involve the most important conclusions in terms of precedential value for other ongoing cases, impact on future enforcement actions and related market legislation.

Market definition and competitive constraints

The Judgment upholds the Decision’s definition of the relevant markets (paras. 120 to 254) and its subsequent finding of Google’s dominance on the markets for licensable OSs, for Android app stores and for the provision of general search services (paras. 235 to 273). Among other things, the Court clarifies the fact that the markets concerned are “distinct but interconnected” (para. 120).

This assessment is one of the most relevant aspects of the entire case, as it relates specifically to the relationship between Apple and Google. Google’s core argument was that it merely reacted to the “fierce head-to-head competition from Apple” (similar to its core argument in the Google Search (Shopping) case, where such purported core competitor was Amazon). The Court clarified that there is no such direct competitive threat from Apple, thus confirming the Decision’s in-depth analysis. The Court also reiterates that the purpose of determining the relevant market and the dominant position held on that market is “to verify that there are no external competitive constraints from products, services or territories other than those which form part of the relevant market under consideration” (para. 109). The Court acknowledges that due to the particularities of digital markets, where innovation, access to data and user behaviour may be more relevant than traditional (market share) parameters, a “multi-level or multi-directional examination” is required to determine competitive constraints (paras 116 to 117). Applying such adjusted standard, supports the EC’s findings.

Specifically, the Court concludes that non-licensable OSs exclusively used by vertically integrated developers – like Apple’s iOS – are not part of the same product market. This follows from the simple fact that third-party device manufacturers cannot license such OSs to run their devices. On a market thus defined, Apple could not exercise any direct competitive constraints on Google; rather, it could only exercise indirect constraints. According to the General Court, it was not apparent from the various items of evidence that the indirect competitive constraints exerted by Apple were capable of preventing Google from behaving to an appreciable extent, independently of its competitors, its customers and consumers (paras. 147, 268).

In this context, the Court acknowledges the evidential value of a so-called “Small but Significant Non-transitory Decrease in Quality” (SSNDQ) test. The Commission had been the first authority to ever apply such test to the freely offered Google services. The Court now confirms that “in the case of a product that was very unlikely to lend itself to the classical hypothetical monopolist test aimed at verifying the market’s response to a small but significant and non-transitory increase in the price of an asset […], the SSNDQ test, which envisages the quality degradation of the product at issue, did constitute relevant evidence for the purpose of defining the relevant market” (para. 177). Such test would not require a precise quantitative standard of degradation of quality of the target product (para. 180).

Based on the EC’s assessment, Google’s allegation that Apple posed a significant competitive threat was rebutted simply by the fact that the two companies have entirely different business models and act complementary to each other, rather than competitors. The Court highlights this important premise for example when referring to the fact that “Apple was party […] to a revenue sharing agreement that was conditional on Google Search being set as the default on Apple’s mobile internet browser, Safari. As a result of that agreement, Apple had no incentive therefore to operate on those markets to compete with Google Search since the use of that search engine by users of iOS devices generated significant revenue for Apple” (para. 272).

In this context, the Court also accepts that the – purported – open-source nature of some parts of the Android source code did not constitute a sufficient competitive constraint to counterbalance such dominant position (paras. 226 to 234).

Abuse of dominance

The Court confirms the abusive nature of Google’s conduct. As regards MADAs, the Judgment confirms that the pre-installation condition created an anti-competitive “status quo bias” because of the tendency of consumers to use the search and browser apps readily available to them on their devices (paras. 320 to 418). In the Court’s words, “the pre-installation of the Google Search and Chrome apps under the conditions laid down by the MADA makes it possible to ‘freeze the situation’ and to deter users from turning to a competing app” (para. 383). Rivals were unable to offset such distribution advantage given the limited use in practice of alternatives paths to access competing search services such as the pre-installation or downloading of such search apps or the calling-up of such services through web browsers (paras. 539 to 567).

In particular, the Court rejects Google’s “rational choice” argument by clearly referring to the importance of behavioural economics, stating that “ a distinction must be made […] between theoretical competition assumptions [that is, the “rational consumer”] and the practical reality, where the competitive alternatives to which Google refers appear to have little credibility or real impact due to the ‘status quo bias’ arising from the MADA pre-installation conditions [that is, behavioural economics] and the combined effects of those conditions with Google’s other contractual arrangements” (para. 428). Therefore, the Judgment (like the Decision) is perfectly in line with case-law such as Cisco Systems v Commission (Case T-79/12, for example at para. 71) or the EC decision in Facebook/WhatsApp (M.7217, for example at para. 111, 124), where equal weight was given to what consumers actually do in practice instead of any theoretical assessment of possibilities. The Court also takes note of the RSAs in this context, as – even if they are not abusive by and of themselves (see below), the fact remains that the share of the contestable market was rather low (paras. 447 to 449). In other words, the RSAs increased the effects of the MADAs (para. 451).

Regarding the assessment of the restrictions contained in the AFAs, the Court believes that the Commission was justified in grounding its case on the assumption that non-compatible Android forks would have posed a credible threat to Google as they could have served as a distribution channel for competing general search services (paras. 843 to 846).

Fine

With a view to the fine, the Court specifically takes note of the intentional nature of the abusive conduct and Google’s overall anti-competitive strategy (paras. 1043 to 1051). According to the Court, “there is no doubt that Google, as the Commission rightly pointed out, implemented the practices at issue intentionally, that is to say, in full knowledge of the effects which those practices were going to have on the relevant markets” (para. 1043). Even after the reduction, the fine will remain the highest antitrust fine ever.

General Court annuls RSA-related abuse on several grounds

With regard to the annulment of the RSA-related abuse, the Court essentially confirms three arguments of Google. First, the Court confirms that the share of the relevant markets covered by the RSAs could not be characterised as significant (para. 693). Second, the Court concludes that the so-called as-efficient competitor (AEC) test carried out by the EC in order to proof the anti-competitive effects of the RSAs contains several errors of reasoning (para. 798). Third, the Court confirms that the EC has infringed Google’s procedural rights in respect to the RSAs, notably its right to be heard (paras. 962 to 1005). Consequently, the Court annuls the Decision in so far as it considers the RSAs in themselves to constitute an abuse (para. 802). Accordingly, it reduced the fine from EUR 4.34 billion to EUR 4.125 billion, a reduction of less than 5%.

The effect of the partial annulment is negligible. Google had already stopped using this type of RSA in March 2014, which is why the partial annulment has no direct practical consequences. More specifically, the partial annulment does also not affect the overall validity of the finding of an infringement (paras. 1016 to 1029). However, the partial annulment is a setback for the EC insofar as there is now a trilogy of cases on pricing abuses (Intel, Qualcomm and now Android) which have set a very high burden for the EC to successfully bring such cases (see specifically paras. 679 to 689 and 692).

Why does the Judgment matter?

The Judgment is of utmost importance for the enforcement of competition law, especially in digital markets. Following some recent defeats before the General Court in tech cases involving Intel, Qualcomm and Apple, the Android Judgment is already the second victory of the EC against Google in a series of high-profile cases that have attracted the attention of antitrust enforcers around the globe. The Judgment confirms the crucial role that Android plays in the “Google Universe” and Google’s tight grip over the mobile platform. The importance of Android – which is now also available on all kinds of different connected devices (for example, smart TVs, cars) – will increase significantly in the future, including the relevance of the data gathered at every touchpoint in the Android ecosystem. Such data helps to reinforce in particular Google’s data-driven advertising and revenue generating services.

The Judgment has also great precedential value for other ongoing enforcement actions. For example, there are numerous ongoing cases against Apple around the globe, all of which rely on the now confirmed finding that the mobile ecosystems of Google and Apple are not in direct competition with each other. Rather than competing intensely on the same markets, Google and Apple each exercise control over their equally walled-off ecosystems – two parallel technological monopolies for the distribution of apps and for reaching consumers. Users are locked within the respective ecosystem due to high switching costs (so-called “path dependency”), and software developers have to create apps for both platforms in any event. Internal communication revealed in the context of antitrust enforcement of the US Department of Justice against Google demonstrates that Google and Apple have a common and aligned interest in dividing users among each other, notably in an effort to share monopoly profits generated on Apple devices with Google’s core advertising services (see below). In the words of a senior Apple employee writing to a Google counterpart in 2018: “Our vision is that we work as if we are one company”.

Last but not least, the Judgment is relevant for forthcoming EU legislation as well. In particular, it is important for the interpretation of specific prohibitions contained in the European Union’s landmark legislation for so-called “core platform services” designated by the EC under the forthcoming Digital Markets Act. A setback for the EC would equally have been a setback of the legislation and its interpretation.

Can Google and the EC appeal the Judgment?

Yes. Google and the EC can bring an appeal (or a cross-appeal) against the Judgment before the Court of Justice of the European Union, Europe’s highest court. Such appeal is limited to questions of law. The time limit for appealing the first instance’s Judgment is 24 October 2022.

Although the General Court’s Judgment is clear and compelling, it is likely that Google will appeal (as it did with regard to the Google Shopping judgment of the General Court of 10 November 2021). However, considering the well-established case law on tying practices underlying the finding of abuse, in the authors’ (subjective) view, the prospects of such appeal are rather low. The EC in turn did, for example, appeal Intel – which is now a second time before the CJEU – but did not appeal Qualcomm. It is likely that they would appeal the RSA annulment (only) if Google appealed the main decision.

Are there other investigations into Android pending?

Yes. Google’s practices with regard to Android have sparked great interest of competition enforcers around the globe. There are so many actions that it is difficult to keep track. Specifically, Google’s practices in relation to Android have triggered enforcement actions by government agencies of – at least – Russia, South Korea, Turkey, India, Australia, and Brazil, who are or have been investigating and/or fining Google for evidence of conduct related to the types of conduct prohibited by the Decision. Android played an equally decisive role in the German Bundeskartellamt’s decision to designate Google as an “undertaking with paramount significance for competition across markets” under Germany’s new big tech antitrust legislation.

In addition, there are several cases that are ongoing. For example, the EU is currently probing whether Google is exploiting Android to sideline rival voice assistants. Moreover, the Korea Fair Trade Commission found in another investigation into Google’s Android practices that the company abuses its dominance vis-à-vis all kinds of smart-device makers (phones, watches, speakers, etc.) in connection with the AFAs. The Seoul High Court recently rejected Google’s request to suspend the agency’s cease-and-desist order.

Most importantly, the US Department of Justice and numerous US States are currently suing Google before the US District Court for the District of Columbia (see here) in a case partially mirroring the EU’s Android investigation. However, their Complaint is much broader and does also entail Google’s RSA with Apple, under which Apple participates in Google’s monopoly search advertising revenues on all Apple devices and which is reportedly worth up to USD 15 billion per year. Unlike in the EU, in the US structural remedies such as a divesture order for specific parts of the conglomerate are a real risk for Google.

Have the competition concerns related to Google’s conduct been solved?

No. While Google implemented a mechanism to comply with the EC’s Decision, competitors are still unhappy with the way this is being done. Above all, Google only started moving towards compliance more than three years after the prohibition and fining Decision. Up until then, Google was clearly non-compliant with the EC’s order. Google had originally implemented a mechanism where rivals could buy a placement in a “Choice Screen” shown to some Android users. However, the design of the Choice Screen was highly controversial, notably because Google had implemented a pay-to-play scheme and limited the number of available alternatives significantly. Originally, rivals were forced to bid in quarterly auctions. Such auctions were heavily oversubscribed, because Google artificially limited the available slots. Only after further pressure by the EC and rivals did Google start to offer a free Choice Screen with more available slots.

However, many concerns remain. For example, the Choice Screen is only shown to new users on new devices at initial device setup, and not to existing users periodically. Moreover, Google is nudging users in several ways not to switch to rival services. The remaining obstacles favour Google in many ways, for example due to its brand advantage and the timing of the presentation of the screen, and because of the limited space and time to properly inform users about the advantages of competing search services (see here for principles that any effective choice screen should follow according to Google’s competitors). Moreover, the choice of the default search service within the dominant Google Chrome browser still favours Google. All in all, the remedy is not a “restorative remedy”, which means that Google can basically keep the substantial benefits of the past abuse.

In a market study report on mobile ecosystems, the UK Competition & Markets Authority confirmed that the remedies implemented by Google following the Decision have done little to foster competition in mobile search and browsing. Google is now simply paying device-makers to gain default status on smartphones for its own services, and users rarely download alternative search engines or web browsers through the Choice Screen Google implemented.

In addition, the Decision only addressed the tip of the iceberg. It is limited to condemning the most obvious abuses of dominance under well-established case law, those that fit the overall theory of harm that Google participated in a single and continuous infringement of Article 102 TFEU to shield its core revenue generating service Google Search – that is, its cash cow – from competition. There are several closely related concerns that remain unaddressed:

- For example, the Decision only concerns the bundling of some of Google’s apps and services (that is, those who are directly used to cement its search dominance). However, the bundle of apps that Google obliged manufacturers and operators to pre-install on Android devices under the MADAs is much larger. It contains up to 30 apps and services. Thus, any illegal competitive advantage that Google obtained in any other market than general search was not covered by the Decision, but may constitute an abuse nonetheless. The Decision’s rational could easily be applied to find illegal tying in those instances as well.

- Moreover, alternative browsers – except for the ones developed by Microsoft – also come with Google Search as the default search service. Google has plenty of comparable deals with other companies that have effects similar to those prohibited by the Decision. For example, Google reportedly pays Apple up to USD 15 billion every year to keep Apple out of the market for general search services and to ensure that Google Search is the default search service in all search entry points on every Apple device (iPhones, iPads, Macs, etc.). Similar revenue share agreements are in place with independent browser developers such as Opera and Mozilla, who all benefit of Google’s monopoly profits on the market for search engine advertising. This also explains why some of such parties supported Google’s appeal as interveners before the General Court.

Where can I find more information on this case?

The Case is registered under the court file T-604/18.

Today’s General Court Judgment

The General Court's press release

The EC decision

The EC press release of the EC Decision

Information about the remedy implemented by Google

Disclosure & transparency

Hausfeld advised and represented the industry associations BDZV, VDZ (now MVFP), and the Open Internet Project (OIP) during the administrative procedure that led to the Google Android Decision and has since advised the French general search service Qwant and a number of other search services and stakeholders on questions related to Google’s (non-)compliance with the remedy imposed. In addition, Hausfeld represented BDZV, VDZ (now MVFP) and Qwant before the General Court of the European Union as interveners on the EC’s side in Google’s appeal against the Decision.